There are 3 types of attendance offences that can be recorded for an employee: lateness, early leave, and absence.

Attendance offences can't be recorded for an employee unless they're assigned to a worktime (and the offences rules are enabled). When that happens, the following can be recorded:

Late check-in offence: If the employee checks in after worktime have started,

And early leave offence: If the employee checks out before the end of worktime,

And absence offence: If the employee doesn’t check in (or if they don’t check out according to the worktime settings).

Penalties are the deductions that result from these offences. These penalties can be calculated in two ways:

A deduction by a certain percentage of the daily wage (monthly salary/30), and this percentage is set based on how many times the same offence happens during a specific time period called repetition period.

A deduction for the number of minutes absent from work.

The penalty can be calculated using both methods or just one of them.

You can set how penalties are calculated and more by editing the offences rules on the offences rules page.

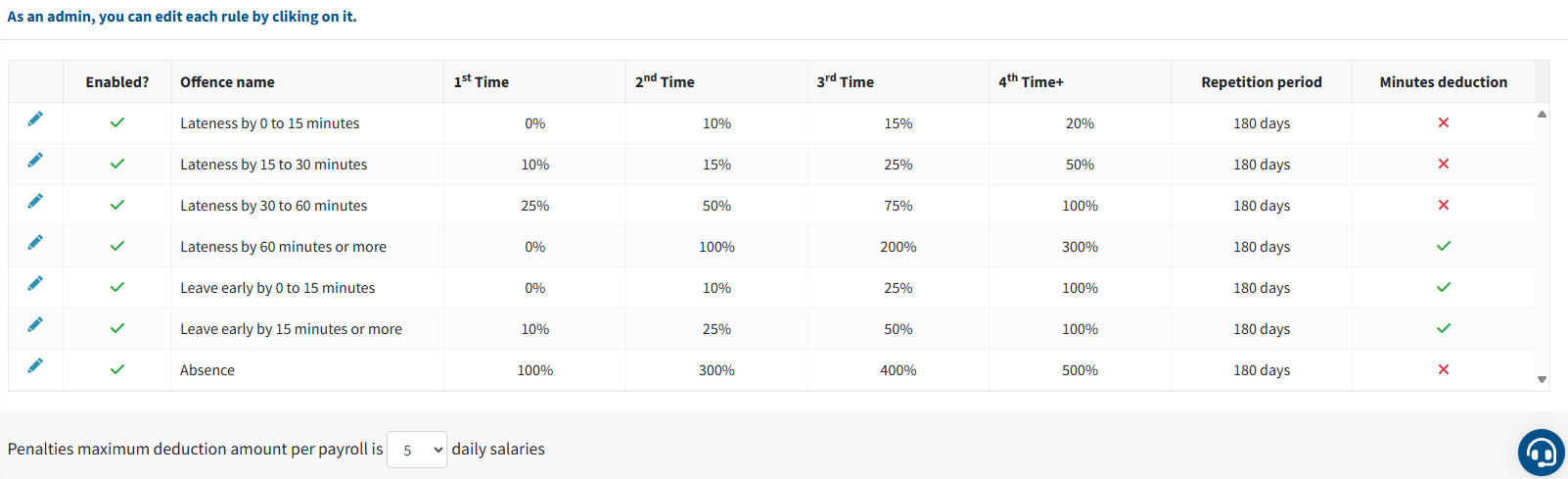

From the sidebar, click on offences Rules, and you'll see the offences rules page with a table just like in the picture below. The table has several columns you can edit (to know more about the columns, click the button below).

Offence name: Description for the violation,

Repetition columns (1st time): This column shows the deduction percentage of daily wage if the offence is repeated once during the repetition period, and the same for the other repetition columns (2nd time, 3rd time, 4th time+).

Repetition period: The period considered to determine the number of times the offence is repeated.

Example: If the repetition period is 180 days, the system will count the repeated offences like this: it checks the last 180 days before the offence date and counts the offences of the same type that happened in that window.

Minutes deduction: Determines if the offence penalty will include deducting the wage for missed minutes of work.

Example: If you want to calculate the offence penalty based only on deduction for absence minutes without deducting a percentage of the daily wage, just enable Minutes deduction, and fill all the Repetition columns with value 0.

Enabled: Determines if the rule is enabled or disabled.

The max fines deduction from the salary for one month is listed below the table.

Example: Assume the offences rules for the company are like the picture above, the employee's daily wage is 120 SAR, and they work 8 hours a day (=> per minute wage is 0.25 SAR), and the employee left early by 5 minutes for the second time in the last 180 days, then the deduction will be calculated as:

Deduction type | Formula | Calculation | Result |

Deduction of a specific percentage of the daily wage | Daily wage * deduction percentage | 120 * 10% | 12 SAR |

Deduction for missed work minutes | Per minute wage * missed work minutes | 0.25 * 5 | 1.25 SAR |

Total deduction | Sum of both deductions | 12 + 1.25 | 13.25 SAR |

Click on the rule you want to edit, then hit the confirmation mark.

Changes will only affect new violations, not the old ones.